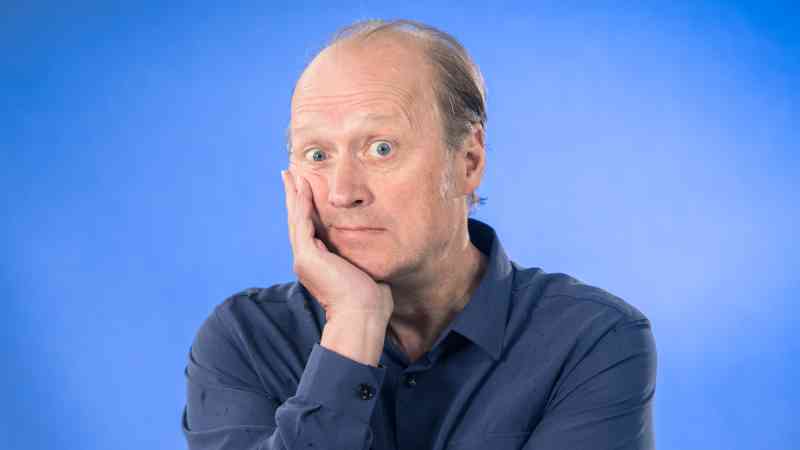

Adrian Edmondson: ‘I blew my first wage at a Berni Inn. I ate the lot’

The comedian and actor Adrian Edmondson, 67, was born in Bradford, went to Pocklington boarding school from age 11 then studied drama at the University of Manchester where he met his comedy partner Rik Mayall. The pair appeared in The Young Ones, (Edmondson was the student punk Vyvyan Basterd), Bottom and The Comic Strip Presents. Away from comedy he has appeared in Star Wars: Episode VIII — The Last Jedi (2017), hosted the Out to Lunch podcast and is a children’s author. He has been married to the comedian Jennifer Saunders since 1985 and they have three grown-up daughters — Ella, Beattie and Freya — and live between Devon and London.

I always leave the house with a minimum of twenty quid on me. It’s my emergency money — enough to get me home if the cashless systems I use suddenly stop working. If I’m going slightly further afield I’ll bump it up. I feel nervous if I haven’t got my “getting home” money on me. I don’t have an actual wallet anymore, I just stick it in my trouser pocket, which is why I like the new, smaller, more durable notes. They also survive the washing machine much better. But I generally pay for everything with my phone, so you could say I carry all my money in my wallet.

What credit cards do you use?

I’ve never used a credit card for actual credit. I’ve always paid them off by direct debit every month. I hate the idea of someone charging me an extra 25 per cent for buying a loaf of bread or some underpants. I mostly use the debit card from my bank, but I also have an Amex card and a Barclaycard. They’re just back-ups really. My bank stops my debit card if there are more than five transactions in an hour — it’s an anti-fraud thing — so at Christmas, or at the fair, or in a pub, I can suddenly end up needing a back-up. In the past I used the Amex card most because it used to have a good rewards system. The Barclaycard is a back-up to the Amex card — I feel rather guilty about having it because as students we boycotted Barclays for propping up apartheid in South Africa.

• Mick Miller: ‘I won $2k at roulette in Vegas, all because of the buffet’

Are you a saver or a spender?

I do spend money, quite a lot of it, but at heart I’m a saver. I fell into debt as a teenager and it scarred me for life. I tricked the bank into letting me withdraw more than I had in my account. They wrote to my mum but I intercepted the letter and wrote back “as her”. Things spiralled out of control and ended with me feeling humiliated and considerably poorer. The pressure was unbearable and I’ve assiduously avoided debt ever since. So I’ll only spend what I have. And not even that — I set aside 50 per cent of anything that comes in to cover tax, national insurance and all that gubbins.

What was your first job?

At 16 I worked changing gas bottles on caravans at a holiday camp near Scarborough and in the evening, I’d man the booth in the penny arcade. This was around 1974 and I think my first week’s wages amounted to nearly three quid. I blew it all at a Berni Inn; I had everything — the steak, the Black Forest gateau, and the Irish coffee — and spent what was left on vodka and limes at the pub next door. I got home late to find my Dad had called the police.

Do you own a property?

We own two. We think of Devon as home, but have a place in London where we stay when we’re working. As a kid, because of my dad’s wanderlust, we moved house nearly every year. Perhaps as a reaction to that, I like to stay put. We’ve had the Devon place since the early Nineties. It’s a granite long house, about 400 years old, that used to be part-barn, part-house. It’s quite modest really, three bedrooms. It’s just me and Jennifer now, the kids are all in their thirties. I don’t think it’s increased in value in any kind of sensational way, but that doesn’t really bother me as it’s where I live and I love it.

I love the London house too, we’ve had it 15 years, but it’s never been a family home — the kids had all left home before we got it — so the emotional tie isn’t as strong. It’s fair to say that it has increased in value. It’s the buffer of all buffers. When the time comes, we’re going to flog it and “piss it up the wall”.

Are you better off than your parents?

My dad was a teacher who taught in England, Cyprus, Bahrain, and Uganda, sometimes teaching forces kids or as part of some kind of foreign aid package. I have an abiding image of Dad getting his papers out every evening and sitting at the dining table, working out all his various bits of pension from here and there, looking at the day’s interest rates in the newspaper, and working out when he could retire. To the day. He hated his job. But when I told him I wanted to be an actor he stopped the car in a lay-by and gently rocked back and forth with his head in his hands. When he finally emerged from his torment he wailed, “Adrian — you’ll never get a mortgage!” But I did. In fact only 15 years later I had one for a quarter of a million quid, which was quite a big one for the late Eighties. When my parents retired I gave them a sizeable wedge of cash to help them buy a bungalow.

How much did you earn last year?

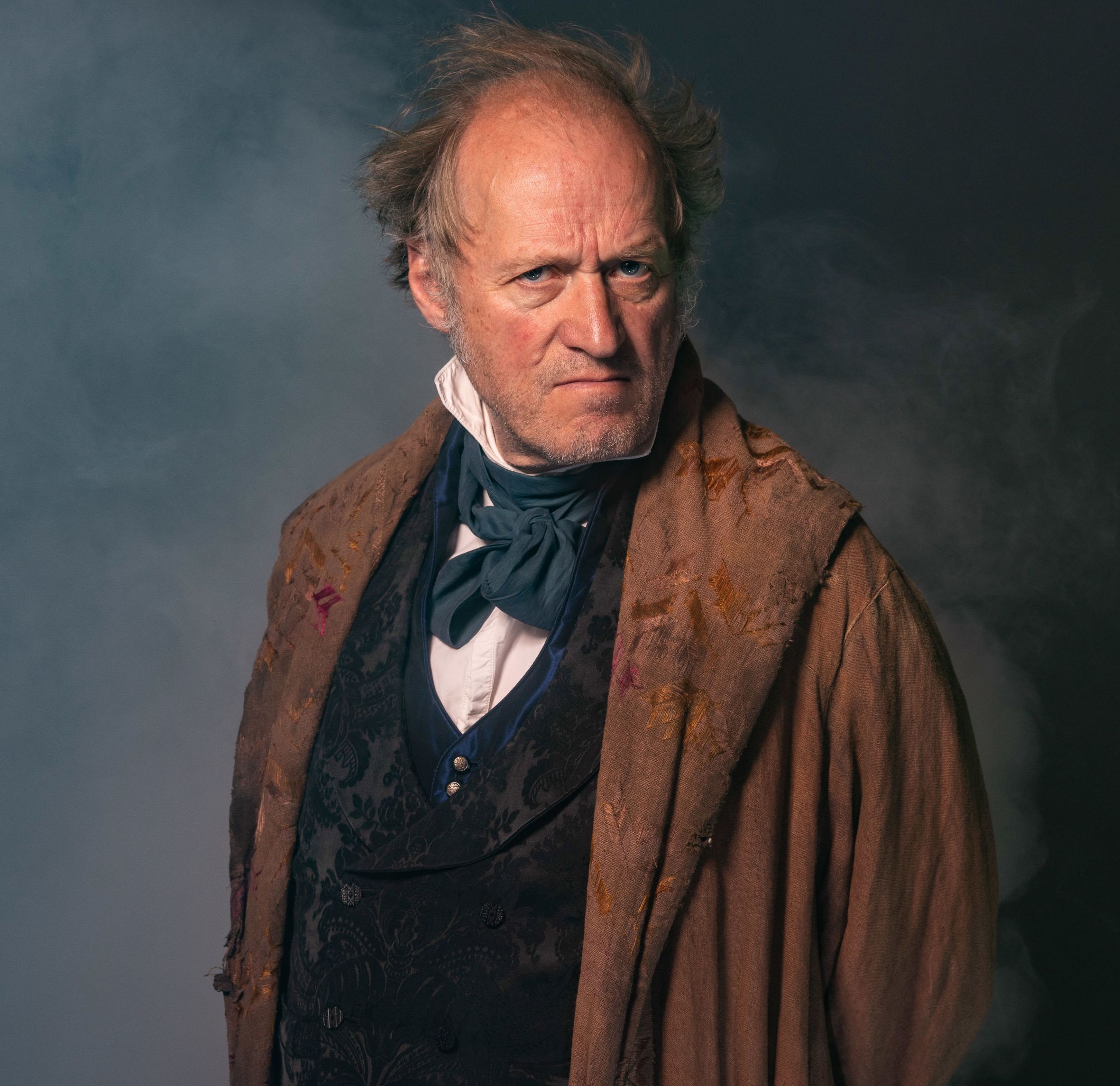

My earnings fluctuate, but since Covid — when I thought I might never work again — I’ve been on a bit of a winning streak. My autobiography’s been doing the heavy lifting this year and looks set to clear its advance if the paperback sells well. I had a play on last year at the Park Theatre in Finsbury Park, north London — it was the culmination on many months’ work and earned me the princely sum of £2,000. On the other hand voicing the Vitality sausage dog over the last few years has earned me tens of thousands a year — although they’ve now moved to a puppy, and apparently my persona isn’t “puppy” enough. So earnings are sometimes very good, sometimes very poor — the trick is to make sure you don’t acknowledge the difference. Playing Scrooge at the RSC wasn’t a big earner, but it was a fantastic job. To be frank, I’m very comfortable financially, I don’t exactly need the money, but I do need to be excited by what I’m doing.

• Guy Henry: ‘When I’m not acting I drive coaches for £14 an hour’

Have you ever worried about making ends meet?

There was a time in 1987 when Jennifer and I had just bought our first flat together in the Fulham Road — I can’t remember how much for, about £57,000 is coming to mind. It was above Luigi’s Delicatessen, close to the ABC cinema and lots of great shops and fashionable eateries. It had been a bit of a stretch, but we talked to someone who persuaded us we could afford it and it was doable. Then Black Monday happened. Interest rates kept climbing and suddenly our mortgage was at 16 per cent. I thought we’d get repossessed. It was weird, because we were in work and earning, but the rate just zoomed past our ability to pay. We stopped shopping at Luigi’s, going to the cinema and eating out, and basically stopped spending altogether. Luckily, within a few months the rate started to come back down again. But it was squeaky bum time and goes to show that we are all at the mercy of those gamblers in the city.

When did you first feel wealthy?

I distinctly remember thinking in around 1980 that I could have a happy life if I managed to clear £10 a day. That it would keep me happily in the life I was accustomed to — a life of not doing very much really, not going on big holidays, or buying a big house, or a flash car, but enough to rub along with my mates and buy a few beers of an evening. The Young Ones and The Comic Strip both started production in 1981 and in that year I cleared £11.43 a day. Life was pretty good — I was a full time actor/comic/writer type person, no longer doing motorcycle messenger work, or filling car batteries with acid, or working in a pork pie factory. The next year my earnings doubled and the year after they tripled to around £30,000. That’s the first time I felt wealthy. I bought a BMW motorbike — a new one — and drove it down to the south of Spain to make Fistful of Travellers’ Cheques for The Comic Strip.

What’s best for retirement — property or pension?

I’m already collecting my state pension; that’s drinking money but not much more. The thing about pensions is that you get the unmistakable feeling someone is screwing you over, but they’re so clever at jargon, and changing their names, or being bought out by some other conglomerate that are even better at inventing spurious charges, that you can never find out how. My feeling is that a house will still be a house after a financial crash. The value might go up or down, but it’s still an actual thing. I’ve been advising my grandson to buy an investment property rather than get a pension.

What was your best investment?

The London house. I think we’ve doubled our money.

And your worst?

I once bought a boat. Just before I bought it a friend said to me, “Buying a boat is like standing in the shower tearing up twenty pound notes,” and he was right. In the end I practically gave it away, but that’s when I stopped haemorrhaging money. I now feel smug about the amount of money I’m not spending on the upkeep of that boat. Over the last 15 years that’s a net gain of £150,000! Is this how money works? Nothing really went wrong with it, that’s just what a boat costs, the upkeep and mooring.

What is your money weakness?

I think I’m pretty good with money. I have a fondness for musical instruments, but have managed to curb that over the last few years. I’d like to have fewer things. Since Covid — and who knows if this is related — but I’ve given more away than I’ve brought into the house. We splash out on big family holidays in Italy with all the kids and grandkids, but I wouldn’t call that a weakness, I’d call that the whole point of money in the first place.

What’s been your most extravagant purchase?

The boat. I’d just earned a shedload of money touring Bottom and spent £150,000 buying the boat. I had it made in America — a Friendship Sloop — beautiful wooden boat, gaff-rigged, a work of art. I named it Acadia because that’s where it was built, in Maine. But it was designed on an old lobster boat and had few refinements. To be exact, there was no toilet. My wife and two of my three daughters hated it. I’m a good sailor but I didn’t get out on it enough to warrant having it.

What is the most important thing you’ve learned about money?

To paraphrase Dickens: keep within your means and you’ll be happy, spend more than you’ve got and you’ll be sad. I don’t think I’m any happier now, financially, than the year I earned £11.43 a day.

Adrian Edmondson’s autobiography Berserker! is now out in paperback

Post Comment